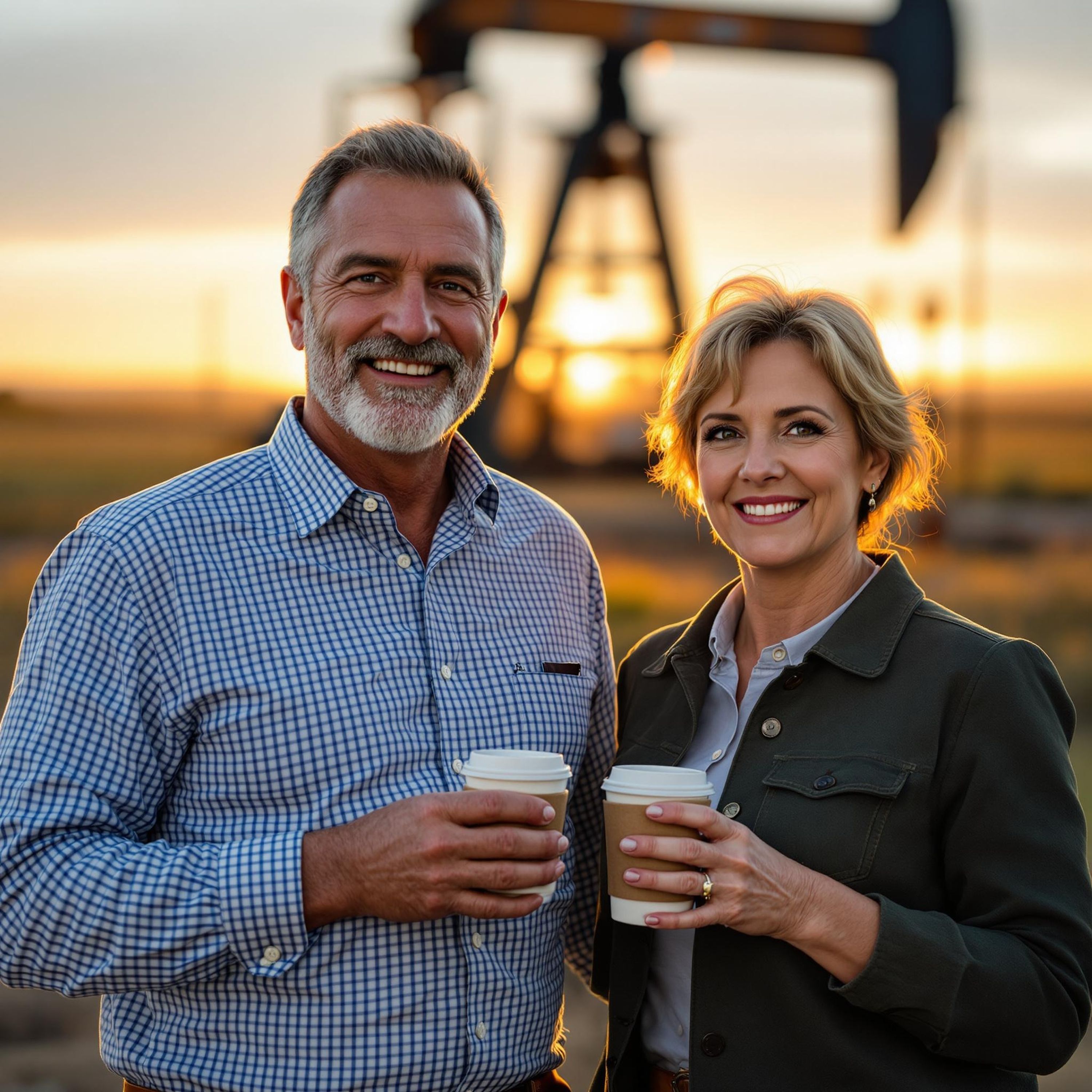

The Blue Collar Millionaire Show

The Blue Collar Millionaire Show shares inspiring stories, investment tips, and wealth-building strategies. Hosts guide blue-collar listeners toward financial independence and retirement success through hard work and smart choices.

How to Stop Victim Thinking and Start Moving Forward

Greg and Chad talk through the last chapter of Forging Financial Freedom and what it actually means to take control of your own life. So much of what we focus on is out of our control and it leaves us feeling stuck. The economy, other people, unexpected circumstances and it’s easy to blame everything around us and wait for someone to step in and fix it.

But the truth is the choices you make in your own home, with your money, and in your habits carry more weight than anything happening outside of you. You can al...

So a Baseball Player, a Football Player, and an Investor Walk into a Bar…

In today's episode Chad and Logan explore the Persistence Over Perfection chapter from Forging Financial Freedom. Using examples from sports legends like Ichiro Suzuki and Frank Gore, they show how small, consistent actions can lead to big results whether in sports, investing, or everyday life.

They remind us that chasing the perfect plan often keeps us stuck, and real progress comes from showing up, doing the work, and staying consistent. This episode highlights how habits compound over time, why persistence matters more than perfection, and how the lessons of discipline and consistency ripple across all areas of lif...

Without a Guide, You’ll Get Lost in the Woods

In this episode of The Blue Collar Millionaire Show, Logan and Greg share a conversation that starts with moose hunting and ends with a lesson about life, mentorship, and financial guidance.

Greg talks about how every year his hunting group manages to bring home a moose, thanks to the experience and wisdom of his dad — a professional guide who spent years teaching others how to read the land and understand the hunt. That kind of knowledge doesn’t come from luck; it comes from walking beside someone who’s already been there.

Logan connects this idea to...

Mold Behind the Drywall: Why Some People Struggle to Ask for Help

Greg has seen it all when it comes to personal finance—from car loans and mortgages to debts owed within families. Over time, he’s realized that even the most responsible savers and planners often carry deep fears and shame around money. In this episode, Logan and Greg continue their three-part conversation about the emotional roadblocks that keep people from getting the financial help they need.

Together, they unpack the fears of judgment, comparison, and complexity that can make it uncomfortable to reveal your full financial story to someone else. They talk about why even smart decisions don’...

From Punching the Clock to Finding Purpose: How 2 Veritas Faces Found Careers They Love

In this episode, Logan Hufford and Greg sit down for an open and honest conversation about their unexpected paths into the world of financial management. Neither started in finance—Logan walked away from a high-paying career in the car business in search of balance and purpose, while Greg transitioned from welding and teaching in the trades to to retirement planning after connecting with Veritas founder, Chad Hufford.

Together, they talk about how their blue-collar values, life experience, and personal growth shaped their work today at Veritas. They share openly about recovery, the power of vulnerability, and how he...

Following Passions and Exploring New Paths with Danielle Allen

Some people take one career path and stick with it for life. Danielle Allen has never been afraid to chase new challenges—firefighter, paramedic, commercial pilot, and now podcast host. Through it all, she’s carried the same drive for excellence and a love for learning.

In this episode of The Blue Collar Millionaire Show, Danielle opens up about what it really looks like to follow your interests, even when they take you in completely different directions. From mountaineering goals to picking up trash in her neighborhood, Danielle shows that passion and purpose can be found in both...

Lessons in Gratitude and Purpose: A Reflection on Tim Tillman’s Story

Greg and Chad sit down to reflect on Chad’s previous conversation with Tim Tillman and the lessons that continue to ripple out from his story. Tim’s approach to retirement wasn’t just about building financial independence—it was about creating a life filled with gratitude, purpose, and impact.

In this debrief, Greg and Chad share what stood out most, including the reminder that we don’t need to wait for a tragedy to wake us up. People will always say it’s not a good time, but important choices are rarely easy in the short term. Tim’s...

The Hidden Heist: Taking Control of Your Money with Bill Cates

In this episode, Chad Hufford sits down with longtime friend and author Bill Cates to discuss his new book, The Hidden Heist: Stop Robbing Yourself of Lasting Wealth. Unlike his earlier work for financial professionals, this book is written for everyday people, showing how mindset and behavior can quietly rob us of financial independence—and how to take control of your money.

Through a creative parable centered on a bank robbery, Bill shares common money mistakes, real-life lessons, and why simple principles and consistent habits matter more than technical knowledge. He also highlights the importance of mentorship, ro...

Habits, Purpose, and a Meaningful Retirement with Tim

In this episode, Chad sits down with Tim for a powerful conversation about retirement—not just preparing financially, but also creating a meaningful life after stepping away from a career of service.

Tim brings wisdom from his own journey, having retired after 33 years with FedEx. His story shows how small, consistent habits—like saving a little at a time and taking advantage of employer matching programs—add up to financial freedom. Tim’s savings mindset started early, and he shares the moment retirement began to feel real and tangible.

But this conversation goes beyond money. Tim talk...

Discipline and Boundaries for Growth in Work Family and Fitness

This week on the Blue Collar Millionaire Podcast, Chad Hufford and Greg revisit one of their most impactful conversations—an inspiring sit-down with Chris Marchant. Together, they discuss the ongoing challenge of balancing work, fitness, and family life, and share real-world strategies for living with discipline and intention.

Chad reflects on how he used to choose the easy path, avoiding hard things, and how Chris’s example challenged him to embrace the work required for real growth. Greg opens up about setting firmer boundaries between work and home, and the freedom that comes from “giving yourself permission to be...

Balancing Work, Family, and Purpose: Lessons from 20 Years in the Fire Department

Everything feels like a race to the finish line—but what if the real win is learning how to be present while you’re building the life you want?

In this conversation, Chad sits down with veteran firefighter Chris Marchant to talk about what it means to live with purpose in the middle of long shifts, family demands, and the daily grind. After nearly 20 years in the fire service, Chris has learned how to stop carrying the weight of work into his home, how to create rhythms that keep him grounded, and how to keep showing up with...

Reflecting on Cal’s Story: The Power of Consistency

Chad and Greg are back this week to reflect on last episode’s conversation with Cal—a firefighter who made saving for the future a priority early on.

In this episode, they talk about how hard it is to save for the future when you're discontent in the present. Gratitude, Cal shared, was a major part of staying grounded. It helped him resist lifestyle creep, even as his income grew. He didn’t chase the next upgrade or compare himself to others. He stayed focused on what actually mattered to him.

They also break down the di...

The Steady Fire: How an Alaskan Firefighter Built a Financial Legacy

In today’s episode, host Chad Hufford sits down with Cal, a recently retired Alaskan firefighter who dedicated three decades to serving his community. Starting his career at just $9 an hour, Cal shares how he steadily built long-term financial security through smart decisions and consistent habits.

Early in his career, Cal took the advice to start saving by maxing out his contributions to the fire department’s deferred compensation plan—a special retirement account. Despite modest earnings, he committed to saving as much as possible from the start and stayed disciplined even as his income grew and the te...

When Doing Nothing is Doing Everything: Mastering Patience in Finance

In this episode, Chad Hufford and Logan Hufford dig into Chapter 6 of Logan’s book, Forging Financial Freedom. This chapter challenges a common impulse: the urge to act immediately when life gets chaotic. Instead, they explore the power of patience and the wisdom in sometimes choosing to do nothing.

At first glance, “doing nothing” sounds like passivity or giving up—but Chad and Logan show it’s actually about patience and trusting time to work in your favor. When scary or uncertain things happen, our natural reaction is to jump into action. But sometimes, standing firm and letting yo...

Farming an Orchard: A Long-Term Approach to Investing

Welcome back to the Blue Collar Millionaire Podcast. In today’s conversation, Chad and Logan Hufford dive into Chapter 5 of Forging Financial Freedom, where they explore one of the most practical metaphors for long-term investing: farming your orchard.

Too often, investors approach their portfolios like they’re planting a single tree—betting everything on one idea, one industry, or one hot stock. Chad breaks down why this approach leaves your financial future vulnerable. Instead, a healthy orchard—and a healthy investment strategy—requires variety, patience, and consistent care.

Logan shares how this farming analogy helps people und...

Stop Fighting the Wrong Dragons: Rethinking Risk, Retirement, and Real Growth

In this episode, Chad and Logan unpack one of the biggest mistakes people make with money: misidentifying the real enemy. We’re often taught to fear words like “volatility” and “market drop,” but those aren’t the real threats.

These terms get tossed around without context, and when we absorb them at face value, we end up building our financial future on a shaky foundation. “Safe” doesn’t always mean secure. And chasing stability without a strategy can quietly erode your buying power—especially in the face of inflation.

At the heart of this conversation is a mindset shift...

Find Your Number: How to Build a Blueprint for Financial Freedom

In this episode, Chad and Logan walk through a key chapter from Forging Financial Freedom and talk about why so many people feel stuck when it comes to money—and what to do instead.

Nobody would build a house without a blueprint, yet many approach their finances without a clear plan. Hope feels nice, but it doesn’t replace strategy. Without one, anxiety creeps in and progress stalls. A financial blueprint brings your future goals into the present, breaking big dreams into real steps.

They dig into how discipline and intentionality—not income alone—create freedom...

Let the Lion Hunt

Most of us think retirement is the ultimate goal — the finish line where life finally begins. But Logan and Chad want you to rethink that.

Financial freedom isn’t about stopping work. It’s about having options and creating a meaningful life beyond a paycheck. The truth? Retirement wasn’t designed for decades of living after work. Too often, “normal” retirement means feeling stuck, overmedicated, and unprepared.

The problem is, we focus so much on retiring that we forget to live. Saying “My life starts when I retire” only sets us up for disappointment when we get there and...

The Real Risk of Investment

Greg and Chad sit down to unpack something most people misunderstand: risk. Not just the fear of loss or the ups and downs of the market—but the deeper, long-term implications of how we approach money, investment, and income.

The truth is, there’s no such thing as a risk-free life. If you didn’t want to take any risks, you wouldn’t get out of bed in the morning. But when it comes to investing, people often try to eliminate all risk instead of managing the right kind. That short-term mindset can lead to real, lasting harm.

It’s Not If, It’s When: Why a Warrior Mindset Matters

In this episode, Chad and Logan welcome listeners into a powerful conversation ahead of Chad’s upcoming talk with a local police department. But the message isn’t just for officers—it’s for anyone who wants to live with grit, clarity, and purpose.

At the core is the warrior mindset—the ability to think and prepare before you act, to choose resilience before crisis, and to train your mind to endure challenges long before they arrive.

Chad draws from the Spartan concept of “wintering”—putting yourself through something hard now so you can handle what’s coming la...

Dare to Be Different with Your Money—Logan and Chad Hufford Talk Mindset

Logan doesn’t read a ton, but Forging Financial Freedom by Chad Hufford? That one had him hooked.

In this episode, Logan sits down with Chad to talk through Chapter 1, Dare to Be Different—and it’s not your typical finance conversation. Chad isn’t handing out budget tips or retirement formulas. He’s flipping the script on everything we’ve been told about money.

The book pushes back on the idea that we’re “bad with money” and reframes it: we’re just not wired for long-term thinking. We’re built to survive the day, to chase comfort...

Simple Habits, Big Results: Terry’s Story of Wealth in the Trades

Greg sits down with his old supervisor and longtime friend, Terry—a man known for his simple, impactful wisdom and a quiet example of what it looks like to build wealth in the trades.

Terry shares his journey from a kid who moved around a lot and struggled to find stability, to a hardworking tradesman who used discipline, artistry, and smart financial habits to build a strong financial future. From working as a painter and machinist to becoming a supervisor in the school district, Terry walked the path many dream of—and did it all without credit card...

From Military to Millionaire: Jeremy's Journey to Financial Independence and Leadership Success

Join Chad Hufford and Gregory Parret as they chat with Jeremy, a former military member who transitioned to an executive role with profit sharing. Jeremy discusses how military skills helped his career shift, the impact of education on financial success, and lifestyle choices that supported his journey. He also shares insights on selling his company, investment strategies, and how social dynamics affect success perceptions. Discover Jeremy's tips on overcoming financial hurdles, building a strong work ethic, and essential traits for business and leadership. The episode wraps up with a nod to hard work, a sponsor mention for Veritas Alaska, and...

Passing the Torch: Julia Myers on Legacy, Family Values, and Financial Wisdom

Chad Hufford welcomes Julia Myers to discuss legacy, motivation, and financial wisdom. Julia highlights the role of family communication and the psychology of wealth transfer. They explore how personal and cultural money stories influence financial behavior and the challenges of value-based money conversations. The discussion covers aligning financial decisions with family values, using wealth for purpose, and balancing inheritance. Julia offers advice on raising financially mature children and insights from first-generation millionaires. A template for effective family financial conversations is provided. Closing remarks and legal information conclude the episode. (0:00) Introduction by Chad Hufford (0:39) Legacy discussion and guest Julia Myers introduction (1:15...

Building Relationship Capital: The Value of Trust and Community in Financial Success

Chad Hufford and Gregory Parret open with a discussion on fee structures, using a financial consultant metaphor to highlight the importance of building relationship capital. They share a client success story that emphasizes the prevention of financial mistakes. The conversation addresses the topic of fees, underscoring the value of cultivating deep client relationships. The episode explores how fostering community and client engagement contributes to financial success. Closing remarks include a call to action, encouraging listeners to evaluate their financial strategies and consider the role of strong advisor relationships. (0:00) Introduction and fee structure discussion (2:10) Financial consultant metaphor and building relationship capital (7:10...

Overcoming Burnout and Building Success: Insights with Dina Cataldo

Chad Hufford introduces Dina Cataldo, who shares her journey into coaching and the transformative impact it had on her life. The discussion explores the themes of gratitude and defining "enough," while examining societal pressures, comparison, and impostor syndrome. Dina and Chad address the issues of overworking, burnout, and redefining success, emphasizing the importance of overcoming scarcity mindset and negative self-talk with self-compassion. The episode provides goal-setting strategies and how to manage setbacks, along with emotional management during market volatility. Dina highlights the crucial role of mindset in achieving life success. Closing remarks include a sponsor mention for Veritas Alaska, followed...

From Coaching to Finance: Shane Rinner on Toughness, Success, and Relationship Capital

Chad Hufford introduces Shane Rinner, who shares his transition from coaching to financial planning. Shane discusses the value of being coachable and key attributes in athlete recruitment. The episode explores the habit of losing and the significance of toughness in performance, comparing mental and physical toughness and their relevance to investors. Shane provides insights on guiding clients through financial challenges and redefining success in financial planning. The importance of relationship capital is highlighted, alongside Shane's legacy in both coaching and financial planning. The episode concludes with a call to action and a legal disclaimer. (0:00) Introduction to the Blue Collar Millionaire...

From Mechanic to Millionaire: Business Growth and Financial Stability Insights

The episode introduces Scott's journey from owning a sports complex to making a significant community impact. Discussions revolve around overcoming business challenges and planning for uncertainties. Chad shares insights on managing business debt and achieving financial stability. The conversation highlights strategies for responsibly starting and growing a business, viewing wealth as a tool for community impact and personal growth. Listener questions address starting a side hustle and networking tips. An interview with a successful blue-collar entrepreneur is featured, alongside a success story of a mechanic turned millionaire. Financial management in a volatile market is discussed, with sponsorship from Financial Freedom...

Navigating Construction Challenges and Building Generosity in Business

Chad Hufford welcomes Scott Johannes, who provides insights into the challenges and risk management strategies in Alaska's construction industry. The episode delves into surviving economic downturns and outlines effective business growth strategies. Scott discusses the importance of character and generosity, viewing business as a form of ministry. The conversation highlights how these values can shape a successful enterprise. The episode wraps up with closing remarks and a call to action, followed by a disclaimer and additional information for listeners. (0:00) Introduction and Guest Background (2:33) Challenges and Risk Management in Alaska's Construction Industry (4:42) Surviving Economic Downturns and Business Growth Strategies (11:49) Character, Generosity...

Mastering Financial Planning: Strategies for Blue Collar Success

Chad Hufford and Gregory Parret kick off the episode with an overview, delving into the critical necessity of retirement plans and investment portfolios. They discuss the importance of balancing financial plans with diverse investments and highlight the role of coaching in achieving financial success. The conversation shifts to aligning financial strategies with client goals and understanding the psychology behind short-term thinking in finance. The hosts emphasize the value of cultivating relationship capital in financial planning and the need to adapt and correct financial plans as circumstances change. The episode wraps up with final thoughts on sustainable financial strategies. (0:00) Introduction and...

Defending Body & Mind: Krav Maga Unveiled with Cory Davis

Chad Hufford introduces Cory Davis from Krav Maga Anchorage, exploring how Krav Maga differs from other martial arts. Cory addresses common misconceptions in self-defense tactics and industries, emphasizing the importance of training both mind and body for success in self-defense and finance. The discussion highlights managing fear and discipline throughout training, as well as the significance of progress and overcoming ego. Cory shares insights on coachability, confidence building, and gaining fresh perspectives. The episode concludes with Cory's final thoughts, a mention of the sponsor Veritas Alaska, and a disclaimer with legal information. (0:00) Introduction and guest Cory Davis from Krav Maga...

Alaskan Truck Driver's Wealth-Building Journey

Chad Hufford and Gregory Parret introduce Chris Tacci, delving into his background and upbringing that shaped his saving mentality. Chris shares his approach to steady saving and retirement activities, addressing the stigma around wealth-building and investing. His investment journey began with bonds, transitioning to stocks, and he provides insights into stocks, bonds, and mutual funds. The discussion covers target date funds and seeking financial comfort. Chris emphasizes car ownership, debt avoidance, and smart spending, warning against the pitfalls of credit and costly purchases. His generosity and financial philosophy are highlighted. The episode concludes with a call to action. (0:00) Introduction and...

Alaskan Truck Driver to Blue Collar Millionaire

Chad Hufford and Gregory Parret introduce Chris Tacci, who shares his financial journey and early lessons that shaped his approach to money management. The discussion emphasizes building small habits for financial discipline and highlights the significance of spousal support in investment learning. Chris explains strategies for managing fixed income amidst rising costs and offers insights on weathering financial storms. The episode underscores the importance of avoiding and eliminating debt, with lessons from financial crises on living within one's means. Chris discusses transitioning from debt to savings and shares key investment strategies. The episode concludes with reflections on financial planning and...

Financial Responsibility, Real Estate Strategies, and Long-term Planning for Wealth Growth

Chad Hufford and Gregory Parret kick off the episode with an overview of Sam Senter's journey toward financial independence. The discussion begins with the costly consequences of early 401(k) withdrawals and car loans, emphasizing the importance of financial responsibility. They explore instilling these values in children, while Sam shares insights on maintaining a frugal lifestyle and leveraging real estate as an investment strategy. The episode contrasts long-term and short-term investments, highlighting the value of embracing discomfort for financial growth. The significance of a long-term financial plan is underscored, concluding with a listener call to action. (0:00) Introduction and Sam Senter's Journey...

Early Financial Habits, Lifestyle Discipline, and Investment Strategies for Blue-Collar Success

Chad Hufford welcomes Sam Senter, who shares his journey in early financial planning. Sam discusses lessons from financial mistakes and their lifestyle impacts. They explore intentional financial habits, physical discipline, and keeping ego below income. The episode covers lifestyle creep, consistent financial practices, and the role of mentors. It includes a segment from sponsor Veritas Alaska and a listener question on first-time investments. Strategies for blue-collar workers, common financial mistakes, upcoming events, and key takeaways round out the discussion. (0:00) Introduction and Guest Introduction (0:54) Importance of Early Financial Planning and Sam Senter's Journey (3:08) Lessons from Financial Mistakes and Lifestyle Impact (6:03) Transition...

Mastering Budgeting: Strategies, Tools, and Long-term Financial Goals

Chad Hufford welcomes Shana and Vanessa to discuss effective budgeting strategies. They debunk misconceptions, emphasize budgeting's importance for all income levels, and explore the consequences of poor money management. The episode covers budgeting for investing and long-term goals, highlighting automation and a 90-day audit. They balance enjoyment and sustainability using modern tools, emphasizing financial control's impact on life. Practical tips for implementing budgeting systems are shared. Closing remarks and a call to action are followed by a segment from sponsor WealthSimple. (0:00) Introduction to the Blue Collar Millionaire Show and Guests Shana and Vanessa (0:58) Overview of Budgeting Strategies and Misconceptions (3:34) The...

Sam's Story: Budgeting, Overcoming Debt, and Building Financial Discipline

Chad Hufford introduces the episode, diving into Sam's financial story, which highlights the challenges and triumphs of navigating debt culture. Sam shares insights on budgeting and planning, emphasizing the importance of maintaining financial discipline. The discussion explores the journey of investing wisely and underscores the crucial role of spousal support and a strong community in achieving financial success. Sam candidly recounts overcoming financial setbacks, offering valuable lessons for listeners. The episode wraps up with closing remarks, leaving the audience with practical takeaways for their financial journeys. (0:00) Introduction and Sam's Financial Story (4:00) Budgeting, Planning, and the Debt Culture (6:21) Investing and Financial...

Financial Unity, Educating Kids, and Smart Management of Raises

Chad Hufford welcomes guest Sam, who shares his background and financial journey. They discuss the importance of aligning financial strategies within a couple, emphasizing the value of unity in managing finances together. Sam highlights the significance of teaching children about financial sacrifices to instill responsible money habits. The conversation provides practical investment tips, encouraging listeners to start small and build gradually. They also explore smart management of raises and extra income, ensuring these opportunities contribute to long-term financial goals. The episode includes a segment from sponsor Veritas Alaska. (0:00) Introduction and Guest Background (7:49) Financial Strategies and Couple's Financial Unity (10:47) Educating Kids...

Debunking Investment Myths: Tools, Market Timing, and Sticking to Your Financial Blueprint

Chad Hufford and Gregory Parret tackle common investment questions, using analogies to highlight the misuse of investment tools. They present case studies, such as Air France, to illustrate the consequences of poor equipment handling. The discussion contrasts market timing with the strategy of time in the market, debunking the myth of a "silver bullet" investment. Emphasis is placed on adhering to a consistent financial blueprint. The episode concludes with closing remarks and a call to action, encouraging listeners to apply the insights shared. (0:00) Introduction and Common Investment Questions (2:34) Investment Tools and Misuse Analogies (5:17) Case Studies: Air France and Poor Equipment...

Smart Investing: From Vehicles to Rental Properties and Navigating Market Downturns

Chad Hufford and Gregory Parret delve into the intricacies of understanding investments, starting with definitions and examples. They examine whether vehicles and boats should be considered assets or liabilities and discuss speculative assets like gold and cryptocurrency. The conversation shifts to rental properties, highlighting their potential as solid investments. Emphasis is placed on the importance of investments that produce income. Navigating market downturns and the dangers of emotional investing are also addressed. The episode concludes with thoughtful closing remarks. (0:00) Introduction and Understanding Investments (1:14) Definition and Examples of Investments (2:54) Vehicles and Boats: Assets or Liabilities? (8:12) Speculative Assets: Gold and Cryptocurrency (9:36) Rental...