Credit Union Exam Solutions Presents With Flying Colors

Tips for Credit Unions Success on the NCUA Examination. Brought to you by Mark Treichel's Credit Union Exam Solutions.

Organizational Review - What It Means If NCUA Asks For It

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

The dreaded organizational review Document of Resolution or worse yet LUA. What it means and what you should do.

NCUA's Succession Planning Regulation to Change? With JT Blau

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

NCUA has reopened the Succession Planning Rule for public comment. In this episode JT Blau and I discuss the rule and its requirements.

Emergency PODCAST: President Trump Sued by Harper & Otsuka over Firings

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Presidential Power and Independent Agency Autonomy: The 2025 NCUA Board Removal Case

I. Legal and Constitutional Framework

II. The NCUA's Specific Structure and Functions

Conservatorship: When NCUA Removes the Board & What You Need to Know

Conservatorship: When NCUA Removes the Board & What You Need to Know

Episode Summary:

In this special episode, hosts Mark Treichel, Steve Farrar, and Todd Miller dive into the high-stakes world of NCUA conservatorships—when the agency steps in to remove a credit union’s board and take control. Drawing from their extensive experience handling some of the largest conservatorships in NCUA history, they provide insider insights on:

What conservatorship means and when it happensThe role of the NCUA as both regulator and conservatorWhy NCUA often opts for conservatorship over cease-and-desist actionsThe challenges of managing a co...DOGE Days and Deep Cuts: NCUA in Flux with Bacino & McKechnie

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

The NCUA’s boardroom has been rocked. Two board members fired. DOGE staff roaming the halls. Rumors of a regulatory consolidation swirl. In this must-hear episode, Mark Treichel is joined by former NCUA Board Member Geoff Bacino and former NCUA Congressional Affairs Director John McKechnie to unpack one of the most chaotic weeks in recent credit union regulatory history.

From unprecedented dismissals to the looming question of NCUA’s independence, we cover:

🔥 The removal of Todd Harper and Tanya Otsuka: What happened...Emergency Podcast: President Trump Fires NCUA Board Members Harper & Otsuka and What it Means for You

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

White House press secretary Karoline Leavitt defended the firings, saying, “President Trump is the chief executive of the executive branch and reserves the right to fire anyone he wants.”

Warren:

“President Trump just fired two Board Members at the National Credit Union Administration in his continued attack on American consumers. This is the latest attempt by Trump to skirt the rule of law, undermine independent agencies, and illegally purge the government of those who work for the American people.”

Nature Abhors a Vacuum & So Does the Rumor Mill

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Episode Overview:

In this episode of With Flying Colors, Mark Treichel tackles two hot topics ahead of the upcoming NCUA Board meeting:

The Staff Buyout Program: With 145 FTEs already accepting voluntary separation packages—roughly 12% of NCUA's workforce—Mark explores the deeper implications. Could the agency be targeting a symbolic sub-1,000 FTE threshold? Poll results and inside intel help paint the picture.The Wildfire Relief Briefing: Mark offers context for why the interagency appraisal relief rule—issued in January—is now being briefed...NCUA's Net Economic Value (NEV) Framework with Todd Miller

Episode Summary:

In this episode of With Flying Colors, host Mark Treichel is joined by former NCUA capital markets expert Todd Miller to discuss the latest updates to NCUA’s Interest Rate Risk (IRR) Supervisory Framework. Following NCUA’s recent stakeholder webinar, we break down key takeaways, including changes to risk categorization, the elimination of the extreme risk rating, and how these updates impact credit unions navigating today’s economic landscape.

What You’ll Learn in This Episode:

✅ The history and evolution of NCUA’s NEV framework

✅ Why NCUA eliminated the “extreme risk” category and what it means...

Rodney Hood to FDIC, Retirement Rumors & Regulatory Rumblings

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

A quick-hit episode this week! Mark shares thoughts on Duke’s March Madness collapse, the rise of Rodney Hood at OCC, Jim Nussle’s pending retirement, and NCUA’s buyout offers. Plus, a few takes on market volatility, sub debt approvals, and the ever-shifting dynamics at the NCUA Board.

Topics Covered:

Duke’s tourney loss and dynasty hateRodney Hood's possible FDIC moveJim Nussle’s retirement newsNCUA staff buyouts and exam slowdownsThe case for sub debtMarket drops and flight to qualityNCUA: Can You Put That In an Examiners Finding Instead of a DOR?

Episode Title:

NCUA: Can You Put That in an Examiner Finding, Not a DOR?

Episode Summary:

In this episode of With Flying Colors, host Mark Treichel is joined by Steve Farrar and Todd Miller to unpack the complexities of NCUA examinations, examiner findings, and documents of resolution (DOORS). They dive into what makes an issue rise to a DOOR, how credit unions can negotiate findings, and why corporate governance is becoming a focal point in exams.

With their decades of experience inside NCUA, Mark, Steve, and Todd share insights on how...

From the Base to Capitol Hill: Advocating for Credit Unions with Jason Stverak of DCUC

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

In this episode of With Flying Colors, Mark Treichel is joined by Jason Stverak, Chief Advocacy Officer of the Defense Credit Union Council (DCUC), for a wide-ranging conversation on the unique role defense credit unions play in serving military members—and the policy battles threatening their ability to do so.

Jason shares how DCUC advocates for military-affiliated credit unions across a rapidly evolving regulatory and political landscape. From the impact of the Credit Card Competition Act on interchange fees to the overdraft pr...

The Harsh Realities of a CAMEL Code 4 Downgrade

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Episode Summary:

In this episode of With Flying Colors, host Mark Treichel is joined by Steve Farrar and Todd Miller from Credit Union Exam Solutions to discuss the serious implications of a CAMEL Code 4 rating. A downgrade to CAMEL 4 signals significant risk and increased regulatory scrutiny. What does this mean for your credit union? What immediate actions should management and the board take? How does this impact borrowing, liquidity, and operations? Get expert insights into navigating the challenges of CAMEL 4 an...

Year End Industry Data and Credit Union Trends: A Deep Dive with Todd Miller and Steve Farrar

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

In this episode of With Flying Colors, host Mark Treichel is joined by Steve Farrar and Todd Miller to analyze the latest trends shaping the credit union industry in 2024. They dive into the recently released NCUA data, discussing multi-year trends, economic pressures, and how credit unions are navigating challenges such as rising delinquencies, declining net income, and shifting liquidity conditions.

Key Topics Covered:

✅ Multi-Year Credit Union Trends – How decisions made during COVID-19 continue to impact the industry today

✅ Rising Credit...

The Road to Recovery: Managing a CAMELS 3 Rating

So You're a CAMEL Code 3 – Now What?

🎙 Episode Title: So You’re a CAMEL Code 3 – Now What?

Episode Summary:

In this episode of With Flying Colors, host Mark Treichel is joined by Steve Farrar and Todd Miller from Credit Union Exam Solutions to discuss what happens when a credit union is downgraded to a CAMEL Code 3. They break down the implications of this rating, what it means for credit union management, and how to navigate increased NCUA supervision effectively.

What You’ll Learn in This Episode:

✅ What is a CAMEL Code 3...

NCUA in 2025: What to Expect & How It Affects You

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

NCUA Predictions: What Will the Do in 2025?

Treichel: [00:00:00] Hey everyone, this is Mark Treichel with another episode of With Flying Colors. Today I am flying solo and I am calling this podcast something like what I expect from NCUA in 2025. In preparing for today's show, I took some notes going back and looking at NCUA's Agenda from their board action taken in 2025 and am gleaning based on the Trump administration and the Helpman leadership.

What may or what...

What It Means If NCUA Asks To Meet With Your Board Without You

Episode Summary:

In this episode of With Flying Colors, Mark Treichel, along with industry experts Steve Farrar and Todd Miller, discuss a growing trend—NCUA requesting private meetings with credit union boards. What does it mean when regulators ask to meet without management present? Should boards be concerned? And how should they prepare?

With decades of NCUA experience, Steve and Todd share insights into:

✅ Common reasons why NCUA requests board-only meetings

✅ When a meeting with the board chair is routine vs. when it’s a red flag

✅ The importance of listeni...

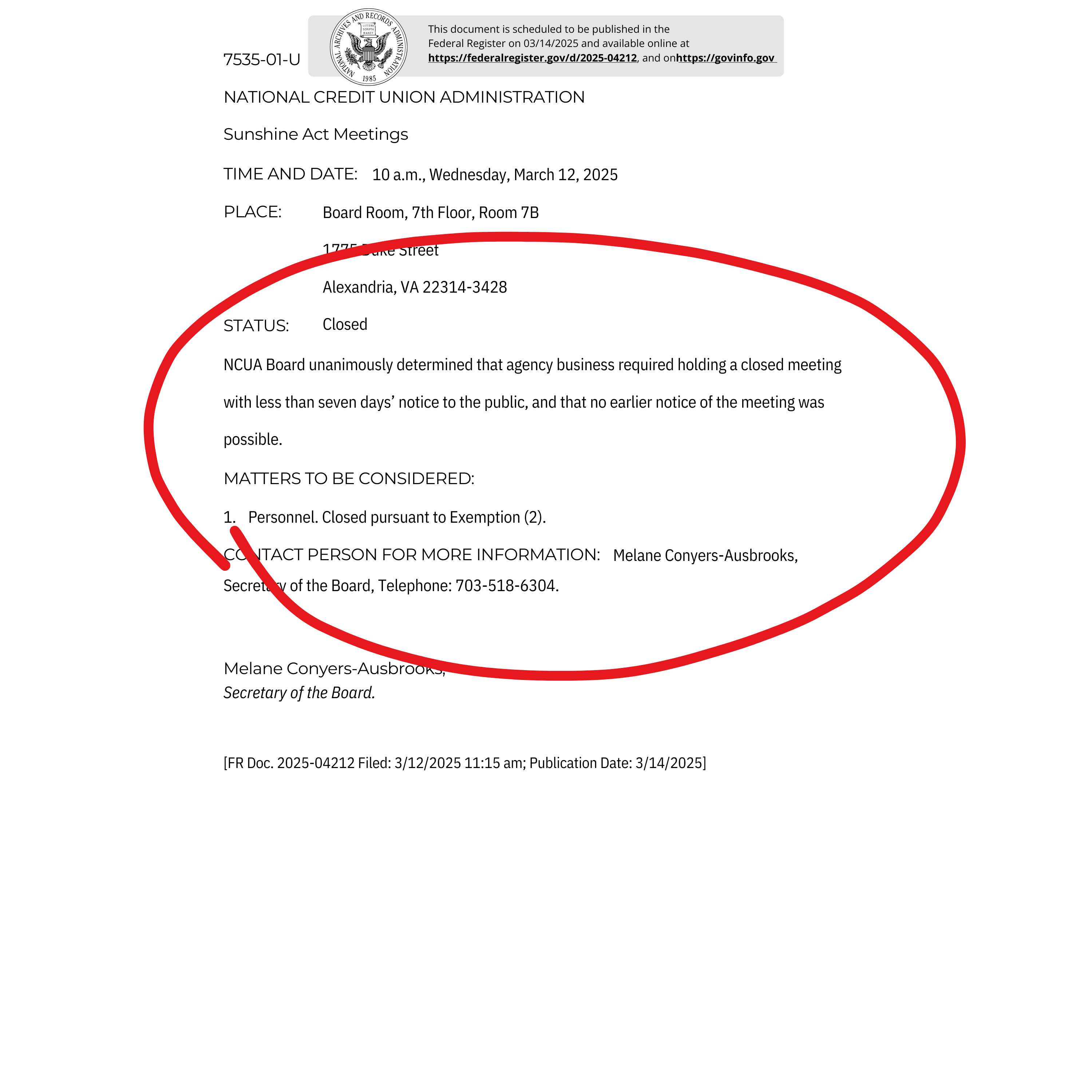

Emergency Pod: Did NCUA Just Vote On It's Trump Mandated Restructuring Plan?

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Did NCUA just vote on its reorganization plan? Time will tell.

https://www.opm.gov/policy-data-oversight/latest-memos/guidance-on-agency-rif-and-reorganization-plans-requested-by-implementing-the-president-s-department-of-government-efficiency-workforce-optimization-initiative.pdf

NASCUS Chair & Iowa Credit Union Division Superintendent Katie Averill

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Recorded just prior to GAC... check out this great interview with Katie Averill of Iowa and NASCUS...

Liquidity Flashback - An NCUA Perspective with Todd Miller

"Liquidity Management: Reading Between the Lines of NCUA's Latest Guidance"

In this insightful episode, Mark Treichel and former NCUA Capital Markets Specialist Todd Miller analyze NCUA's April 2023 liquidity webinar and provide their expert take on the agency's current perspective on liquidity management.

Episode Highlights:

NCUA Pivots on Overdraft Fees and America's Credit Unions Policy Priorities 2025

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

https://ncua.gov/newsroom/press-release/2025/hauptman-announces-changes-ncuas-overdraftnsf-fee-collection

A great Monday at GAC .... listen for details.

NCUA Board Focus: Staff Morale & Safety of Credit Union Deposits

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

NCUA Board focuses on staff morale and safety of deposits. Also what happened to the item making Todd Harper Vice Chairman??

Listen and learn.

Why Credit Unions Could Lose Big in Washington’s Regulatory Reset with John McKechnie

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Episode Title: "Credit Unions at a Crossroads: Regulator Consolidation and the Tax Threat"

With Flying Colors Podcast | Episode [Number] | Released February [XX], 2025

Host: Mark Treichel

Guest: John McKechnie, John Ney LLC, Credit Union Policy Expert

Overview:

In this timely episode, recorded just ahead of the 2025 Governmental Affairs Conference (GAC), Mark Treichel sits down with John McKechnie, a seasoned credit union advocate and former NCUA insider, to unpack the seismic shifts brewing in Washington, D.C. With t...

When DORs Become Letters of Understanding * Agreement (LUAs) What You Need to Know

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Have an LUA, or are you worried about getting one? Don't miss this episode.

The Perfect Storm: Credit Risk and Modern Collections with David Reed

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

The Perfect Storm: Credit Risk and Modern Collections with David Reed

In this episode, Mark Treichel sits down with David Reed, of Reed & Jolly law firm, to discuss the pressing issue of credit risk and loan quality in credit unions. As a former in-house counsel and collections manager turned credit union attorney, Reed brings unique insights into modern collection challenges and solutions.

Key Topics:

Analysis of NCUA's 2024 Supervisory Priorities letter and its unprecedented focus on credit riskRecord-high...What’s Next for Credit Unions - with Mike Macchiarola of Olden Lane

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Show Notes: With Flying Colors - Interview with Mike Macchiarola of Olden Lane

Guest: Mike Macchiarola, Olden Lane (broker-dealer and investment advisor serving credit unions)

Key Topics Discussed:

- Interest Rate Environment: Impact of "higher for longer" rates on credit unions, with industry cost of funds rising to 218 basis points

- Regulatory Changes: Shift in regulatory focus under new NCUA leadership and potential Trump administration impacts

- Consolidation Trends: Record year for credit union-bank transactions (22 in 2023) and...

Breaking News: Rodney Hood Is In Charge of the OCC

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Press Releases

Secretary Bessent Announces Intention to Appoint First Deputy Comptroller of the Office of the Comptroller of the Currency

February 7, 2025

WASHINGTON – Secretary of the Treasury Scott Bessent today announced his intention to appoint Rodney E. Hood as a Deputy Comptroller and to designate him the First Deputy Comptroller of the Office of the Comptroller of the Currency (OCC). In this role, Mr. Hood will also serve as Acting Comptroller of the Currency.

“The stro...

ALCO In Practice: Essential Reports Analysis and Risk Management

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Key Topics to Include:

Economic data and analysisFinancial statement reviewKey performance/risk indicatorsLiquidity reportingInterest rate risk analysisInvestment portfolio oversightScenario testing and stress analysisModel validation and risk assessmentCredit risk integrationDocumentation and minutesDid You Agree to That?

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Summary:

In this special Archive episode of With Flying Colors, Mark explores the meaning and implications of "agreed upon corrective action" in credit union examinations. Drawing from his experience at NCUA, Mark explains how this term appears on examination reports and why its proper implementation is crucial for credit unions.

Key Points Covered:

Mark begins by breaking down the literal meaning of "agreed upon" using dictionary definitions, emphasizing that it means coming to a mutual arrangement or understanding. He...

Kyle Hauptman is NCUA Chairman: What It Means for Credit Unions

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Kyle S. Hauptman Designated as NCUA Board Chairman

ALEXANDRIA, Va. (Jan. 22, 2025) – President Donald J. Trump has

National Credit Union Administration Vice Chairman Kyle S. Hauptman as the thirteenth Chairman of the NCUA Board.

“I am deeply honored that President Trump has asked me to serve as Chairman of NCUA,” Chairman Hauptman said. “I look forward to leading the agency’s dedicated professionals and working with my Board colleagues to create a regulatory structure that promotes growth, opportunity, and innovation within the...

Capital Rules and Risk Management for Credit Unions

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Episode Summary:

In this episode of With Flying Colors, host Mark Treichel sits down with Steve Farrar, a former NCUA examiner and capital expert, to discuss the complexities of credit union capital management. With decades of experience, Steve shares insights into the evolution of capital regulations, the purpose of regulatory capital, and the challenges credit unions face in maintaining the right balance between risk and growth.

Key Takeaways:

Steve Farr’s Background: Steve shares his extensive career journey, from starting as...Overdraft Fees Under the Microscope: NCUA’s Latest Guidance Decoded

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

## Episode Summary: NSF and Overdraft Fees - What You Need to Know

In this episode, Mark Treichel interviews Joe Goldberg, former director of the NCUA's division of consumer compliance policy and outreach, about the December 2024 NCUA letter addressing consumer harm from certain overdraft and NSF fee practices.

### Key Topics Covered:

Joe Goldberg discusses NCUA's recent guidance on problematic overdraft fee practices, including:

1. Authorized Positive Settled Negative (APSN) fees - When a debit transaction is approved with...

Avoiding Document of Resolutions: 10 Essential Strategies for Credit Unions

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Episode Description:

In this special archive episode of With Flying Colors, Mark shares valuable insights from his years of experience in credit union examination and consulting. Broadcasting straight from the beach, he breaks down the top 10 ways credit unions can avoid receiving a Document of Resolution (DOR) from the NCUA. Whether you're preparing for an exam or just looking to fine-tune your operations, these practical tips will help ensure compliance and maintain a smooth examination process.

What You'll Learn i...

Hot Off the Press: NCUA Exam Priority Letter - Our Take

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Our most downloaded episode of the year: Our Take on the NCUA Supervisory Priority Letter.

The NCUA Appeal Process: A Complete Guide

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

The NCUA Appeal Process: A Complete Guide

# NCUA Appeal Process with Mark Treichel

## Overview

This episode covers the formal appeal process at NCUA, detailing how credit unions can appeal examination findings and supervisory determinations.

## Key Points About Initial Response to Examination Findings

- Start with the examiner level - resolving issues at the lowest level is most time and cost-efficient

- Common reasons for appeals include:

- Factual errors not corrected

- CAME...

GOVERNANCE ESSENTIALS: BUILDING AN EFFECTIVE ALCO COMMITTEE STRUCTURE

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Everthing You Need to Know on ALCO CHARTERS AND GOVERNANCE

Key Topics to Include:

Committee charters vs. policiesCommittee composition and member selectionBoard involvement considerationsRole of Chief Risk Officer and other key positionsAuthority and delegation frameworkDocumentation requirementsStrategic alignment with board objectives2024 Summary Show and a Look Forward

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

LUAs - What You Need to Know

Set up a call:

https://calendly.com/cuexamsolutions/talk-to-mark-about-any-exam-topic?month=2024-10

Check out our website:

https://calendly.com/cuexamsolutions/talk-to-mark-about-any-exam-topic?month=2024-10

Are you worried about an NCUA exam in process or looming on the horizon? Don't face it alone!

We're ex-NCUA insiders with decades of experience, ready to guide you to success. Our team understands the intricacies of NCUA examinations from the inside out.

Hire us and gain:

• Peace of mind during your exam process

• Insider knowledge of NCUA procedures and expectations

Crisis Communication - What You Need to Know

Set up a call:

https://calendly.com/cuexamsolutions/talk-to-mark-about-any-exam-topic?month=2024-10

Check out our website:

https://calendly.com/cuexamsolutions/talk-to-mark-about-any-exam-topic?month=2024-10

Are you worried about an NCUA exam in process or looming on the horizon? Don't face it alone!

We're ex-NCUA insiders with decades of experience, ready to guide you to success. Our team understands the intricacies of NCUA examinations from the inside out.

Hire us and gain:

• Peace of mind during your exam process

• Insider knowledge of NCUA procedures and expectations

Credit Union Vs Banks: What You Need to Know About the Insurance Funds

www.marktreichel.com

https://www.linkedin.com/in/mark-treichel/

Reach out to learn how we assist our clients with NCUA so they save time and money:

https://www.linkedin.com/in/mark-treichel/

https://www.marktreichel.com/

FRAUD AND WHY NCUA MUST BE ONSITE

Set up a call:

https://calendly.com/cuexamsolutions/talk-to-mark-about-any-exam-topic?month=2024-10

Check out our website:

https://calendly.com/cuexamsolutions/talk-to-mark-about-any-exam-topic?month=2024-10

Are you worried about an NCUA exam in process or looming on the horizon? Don't face it alone!

We're ex-NCUA insiders with decades of experience, ready to guide you to success. Our team understands the intricacies of NCUA examinations from the inside out.

Hire us and gain:

• Peace of mind during your exam process

• Insider knowledge of NCUA procedures and expectations